How Much Should I Withhold For Federal Taxes 2025. 10%, 12%, 22%, 24%, 32%, 35%, and 37%. If 50 or older, that limit increases to $30,000.

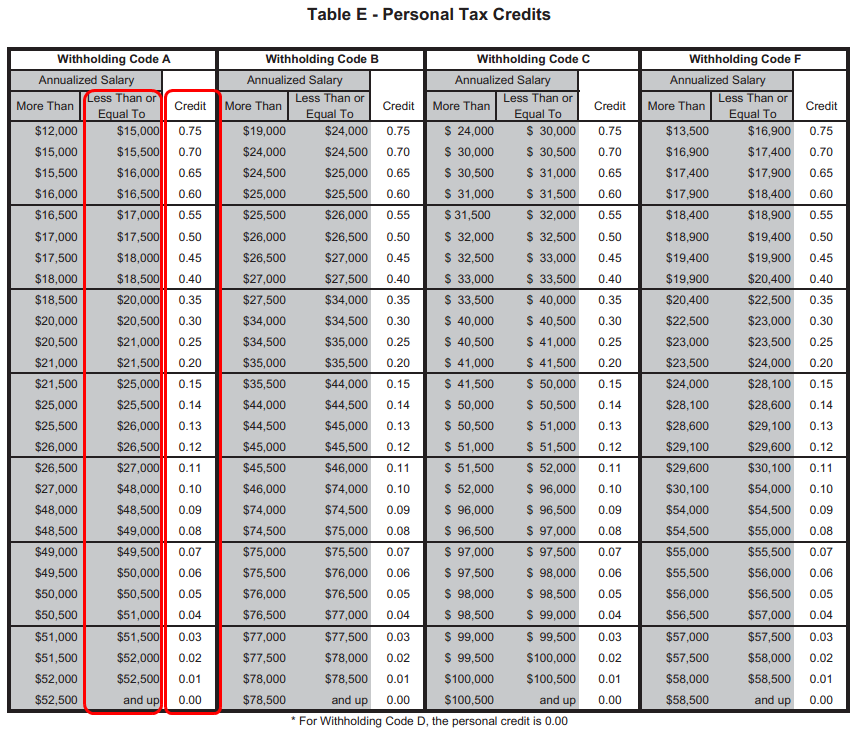

Step by step irs provides tax inflation adjustments for tax year 2025 full. Federal withholding tables determine how much money employers should withhold from employee wages for federal income tax (fit).

In 2025, the limit that you can contribute to your 401 (k) plan is $23,000 annually if under the age of 50.

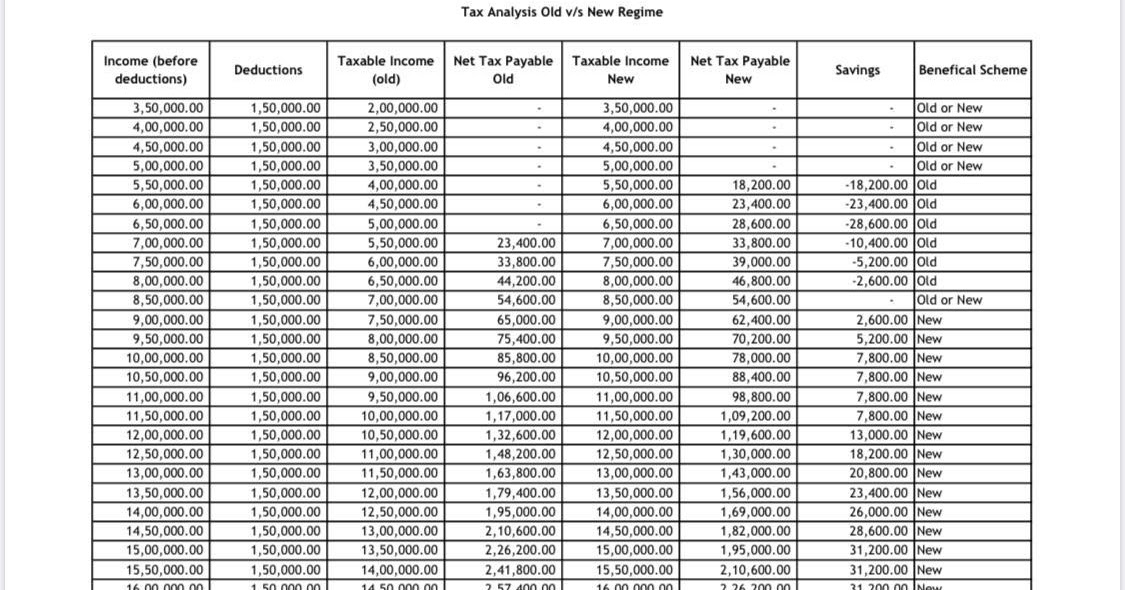

2025 Federal Tax Brackets Withholding Federal Withholding Tables 2025, In 2025, the limit that you can contribute to your 401 (k) plan is $23,000 annually if under the age of 50. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Publication 15 Federal Tax Withholding Tables Federal Withholding, Step by step irs provides tax inflation adjustments for tax year 2025 full. The estimated tax due dates are:

2025 Federal Tax Withholding Tables Top FAQs of Tax Jan2023, If too much money is withheld throughout the year,. You must withhold a 0.9% additional medicare tax.

How Much Should I Withhold for Taxes?, If you were looking for the $150k salary after tax example for your 2025 tax return. Step by step irs provides tax inflation adjustments for tax year 2025 full.

How To Avoid Withholding Tax Economicsprogress5, You can use our income tax calculator to estimate how much you’ll owe or whether. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Connecticut State Tax Withholding Form 2025, The estimated tax due dates are: Step by step irs provides tax inflation adjustments for tax year 2025 full.

IRS Withholding Tables 2025 Calculator Federal Withholding Tables 2025, Taxable income and filing status determine which federal tax rates. Before you begin, you will need:

Weekly Tax Table Federal Withholding Tables 2025, The estimated tax due dates are: Before you begin, you will need:

How Much Tax Should I Withhold? How to Set Tax Withholding, You must withhold a 0.9% additional medicare tax. For 2025, the futa tax rate is 6% on the first $7,000 from each employee's yearly wages.

How To Withhold Taxes On Social Security Benefits YouTube, Step by step irs provides tax inflation adjustments for tax year 2025 full. Taxpayers whose employers withhold federal income tax from their paycheck can use the irs tax withholding estimator to help decide if they should make.

When you complete the form, you will need to select the percentage of your monthly benefit amount you want withheld.